What is High Yield investment and Why Should I care?

What are some examples of High Yield investments?

How do I get started in High Yield investments?

How is High Yield similar to owning Real Estate?

What is a High Yield Investment and why should I care?

Over the last 2 years we’ve seen several new investment vehicles come to light that offer very high yields. High Yield meaning up to 5% yield PER MONTH.

Some of these funds can pay back your initial investment very quickly and create massive total returns.

What does 5% per month look like?

If you were to find one of these high yield funds on finance.yahoo.com one may look something like this:

Yield is the amount paid from distributions or dividends over a year period. So in the above example, this fund was paying 6.82% Yield (81.89 / 12 = 6.82) every month.

Also in this example the monthly distribution averaged ~ $1.33/per share per month!

Notice the previous close was $16.10. If you received $1.33/per share per month (hypothetical) you would recoup your initial investment per share in One Year and Ten Days!

As you can see above, if the yield was 81.89% over the last 12 months, since it was not 100% this means the fund value also went down, otherwise the yield would be 100%+

This is just something to be aware of which I’ll talk about more later.

What funds are these?

If you’re a subscriber you already know which funds I’m talking about that over the last year have paid back the initial investment and continue to earn the investors a similar yield every month.

Getting back to why these funds are able to pay out so high and risks

These new strategies or vehicles, combine some old strategies with a twist by using Synthetic Options.

Basically, these investments are similar in a way to what are known as Covered Call ETF’s such as:

source: https://money.usnews.com/investing/articles/high-yield-covered-call-etfs-income-investors-will-love

Now the difference lies in the method of which these funds write covered calls and how the distribution works.

What is a covered call?

If you own a 100 shares of a stock and options are available to be traded, you sell a call options and if the price closes below your strike you get to keep the premium you were paid.

If the stock closes above the strike you sold the call on then you lose your shares at the price the call option was sold on minus the premium you collected for selling the covered call.

As with options you could always roll your call and other methods so your shares don’t get taken away, but that’s beyond this article. You can read more about covered calls from Schwab as they have a decent covered call explanation here.

What’s the difference between a covered call and these new High-Yield strategies?

High yield income funds work like this: Instead of owning the 100 Shares, they buy a Deep in the money call option (usually expiring in the next month to 3 months) and then sell calls Out of the money from that position.

This allows them to use more leverage and at a reduced cost.

This benefits you the investor because they pay a much higher yield than a typical covered call strategy.

What are the major risks?

So, the value of the fund, or the price you paid or its current price is generally referred to as the NAV (Net Asset Value).

Some funds you may find have a price that continuously drops. This means you may get high-yield but the value of the fund will be lower and lower so over time while you will make money after the yield the value of the fund is essentially becoming worthless and will have to eventually reverse split.

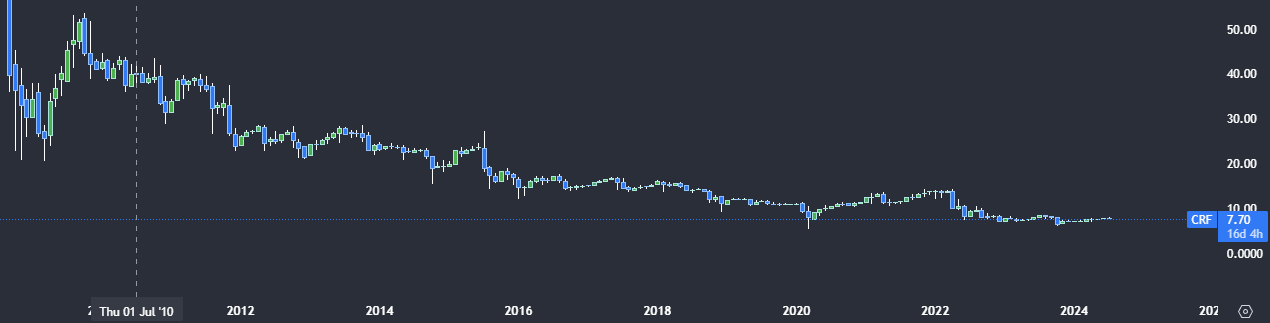

Below is an example of a fund that the NAV simply goes down over time with no upside.

The monthly chart should NOT look like this

We want a high yield fund that moves similar to a “normal” stock. Being able to benefit not only from capital appreciation but also receive large distribution or dividend payments.

If the fund is moving up and down this presents a great opportunity to not only receive dividends but “rip” off the top when there’s a large up move.

I’ll talk about “ripping” in a future article, essentially ripping gives you the best of both worlds, you get capital appreciation and receive monthly distributions.

Find Funds that target specific tickers

Some of these funds target specific stocks with very high Volatility. This means when they are selling these calls, they receive a lot more premium than in most covered call strategies.

How can I determine if a fund is using this strategy?

Refer to the above explanations for the example, the Yield in any financial site will show a very High Yield.

What most people who buy High-Yield Funds get wrong.

I don’t believe there’s a buy and hold forever. Of course depending on your trading style and what works best for you, in my case, buying at a good price, receiving a dividend or distribution and then looking for any opportunity to sell some and lock in profits works the best.

Leverage High Yield as part of your portfolio.

Don’t think this is the Nirvana of investing, when done properly and can have some amazing returns, however, you don’t want high-yield to be your entire portfolio.

I personally segment my portfolio by a certain % in high-yield, % in growth, % in Bonds and a % in commodities.

NOT INVESTMENT ADVICE: You agree that (a) any Service is provided is for informational purposes only, (b) any investment decisions you make are solely at your own risk, (c) neither MaxIncomeYield nor any of its licensors nor third party information providers shall not be responsible or liable for any trading or investment decisions made based on information provided by the Service, (d) the Service does not recommend any securities, financial products or instruments, nor does the Service provide any investment advice or opinion regarding the nature, potential, value, suitability or profitability of any particular security, portfolio of securities, transaction, investment strategy, or financial product, and (e) the Service does not provide tax, legal or investment advice. CFTC RULE 4.41 CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.